Transforming Credit Union Operations with User-Focussed, Scalable Banking Solutions

TALK TO AN EXPERT

Ensuring regulatory compliance at a banking host level saves time and enhances the security of your Credit Union.

Strengthening member relationships with user-centric tools and configurable products.

Improved customer experience & expanded product offerings means opportunity for growth.

Our Universa Core banking system is the heart of credit union innovation. The component tools align with credit union goals for growth and member satisfaction.

Simplified Member On-boarding: Dedicated new member onboarding process that reduce time for member profile creation.

Efficient Transaction Processing: New posting terminal embedded into member profile views enabling simple transaction processing.

Member Based Account Structure: View all accounts associated with a member directly in one view.

Comprehensive CRM: Simply pull information on members to support marketing initiatives and outreach.

Agile Reporting Tools: Daily, weekly, monthly, annual automated reporting & fully customizable query builder to support finding any and all information housed in your system.

Member Fees Management: Dedicated products to automate collection of fees, data integrated into client reporting.

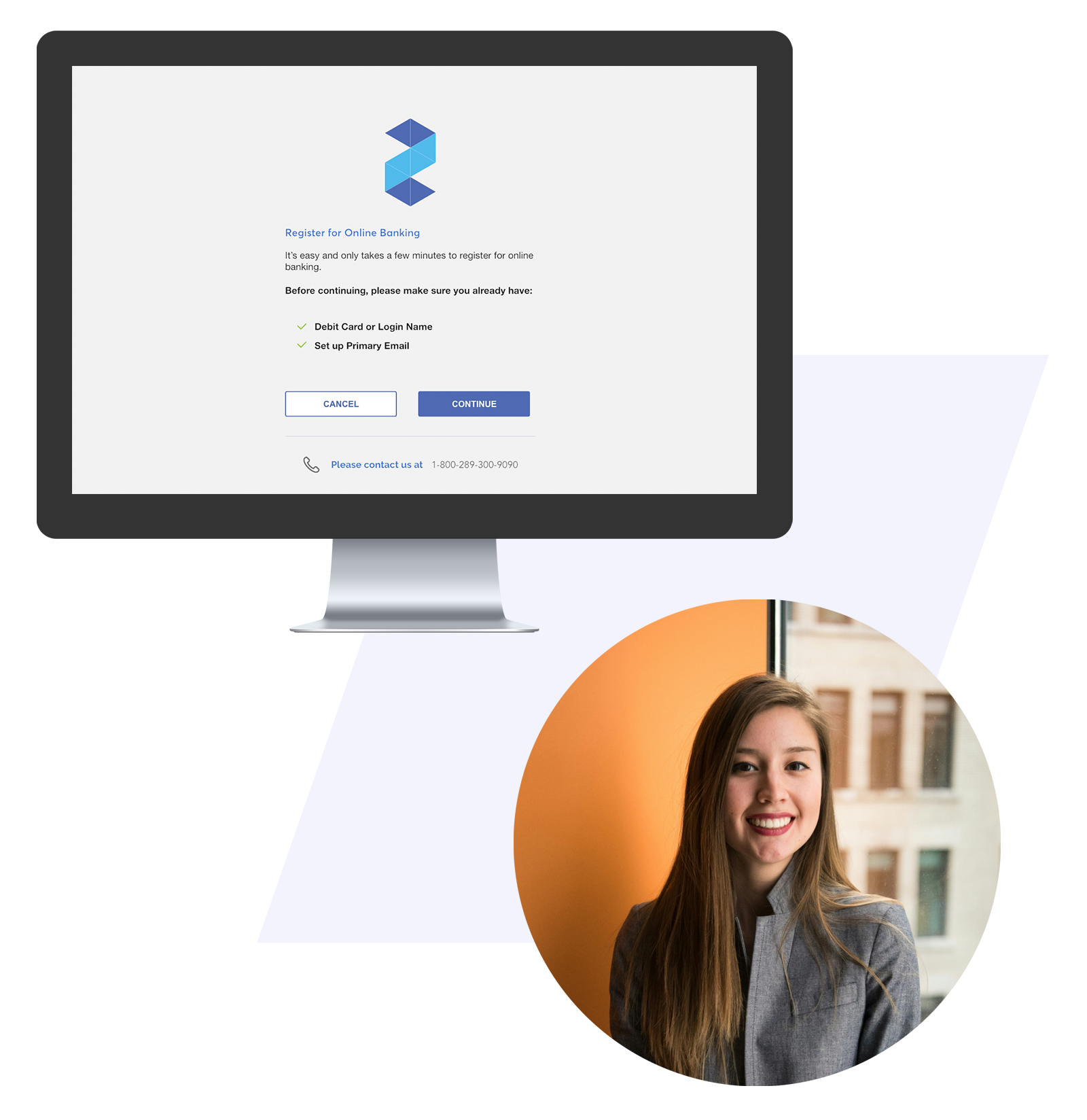

Digitally integrated products enable your credit union to facilitate communication and streamline services. Smart Solutions UniFi Mobile & Desktop products are the backbone to 24/7 accessible services. Transform how members interact with your credit union digitally, using our sophisticated suite of online tools to support communication, streamlined services, and improved digital accessibility

Member Initiated Account Creation: Enable members to create their digital banking accounts without CU interference.

Complete Account View: Members can easily view all balances of accounts directly in the mobile application or an internet browser.

Account Transfers: Facilitate account transfers between member accounts, both within the same member or inter-members.

Bill Payments: Members can pay bills directly through the digital banking suite, from bills to top-ups.

Alerts: Ensure member accounts are kept safe by providing them with alerts for varying types of actions, from large transfers to password changes.

Member Profile Modifications: Enable members to change their profile information directly through the digital banking application.

Improve your revenue growth using Smart Solutions Loan Origination System (LOS). Lending is the backbone to many Credit Union operations, and a system that enables simplified disbursement and comprehensive management is critical.

Loans Calculator: Share different loan options with members, providing them with a simple view to decide on the best loan option for them.

Simplified Loan Creation: Loan details are automatically populated based off member data to enable a simple loan creation process.

Approval Levels: Define an approval process that ensures appropriate loan officers' & managers' sign-offs on loan disbursement.

Recoupment Alerts: Enable alerts that trigger messages to members when loan payments are upcoming to ensure timely payments.

Automated Recoupment: Enable direct payoff of a loan through a member's paycheck to reduce loan repayment risk.

Loan Analytics: A complete query builder and automated reports to ensure complete understanding of your loans book.

Over 50 years of operating we've developed strong relationships with many critical parties in the financial institution sector. Whether you're looking for integrations with our partners, or introductions to their services, please send us a message.

Explore our products or contact us to speak with an expert on what solutions might be right for you and your institution.