Whether you're seeking an advanced loan origination system, a resilient core banking backbone, or the latest in mobile and internet banking – our solutions merge tradition with innovation.

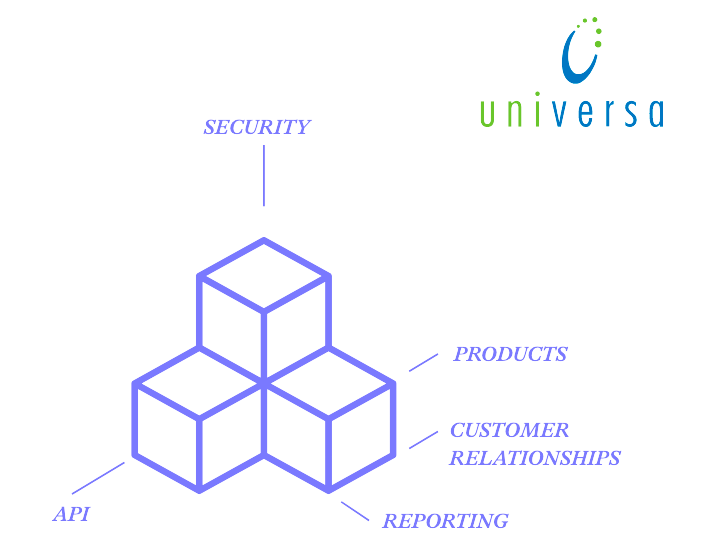

CONTACT SALES START WITH CORE BANKINGWe help you beat fraud and protect yourself, and by leveraging our partner network through an open API platform you can build a seamless, secure, and consistent experience through all your touchpoints.

Universa is the first Canadian owned and made browser based banking solution on the market. With 35 years of business expertise, we’ve developed, and continue to enhance, a complete solution with no shortcuts.

This is the core banking platform to support your customer journeys from start to finish. Onboard customers easily through integrated onboarding flows, manage finances through our state of the art posting terminals, and engage customers to upsell with targeted reporting & marketing automation.

LEARN MORE

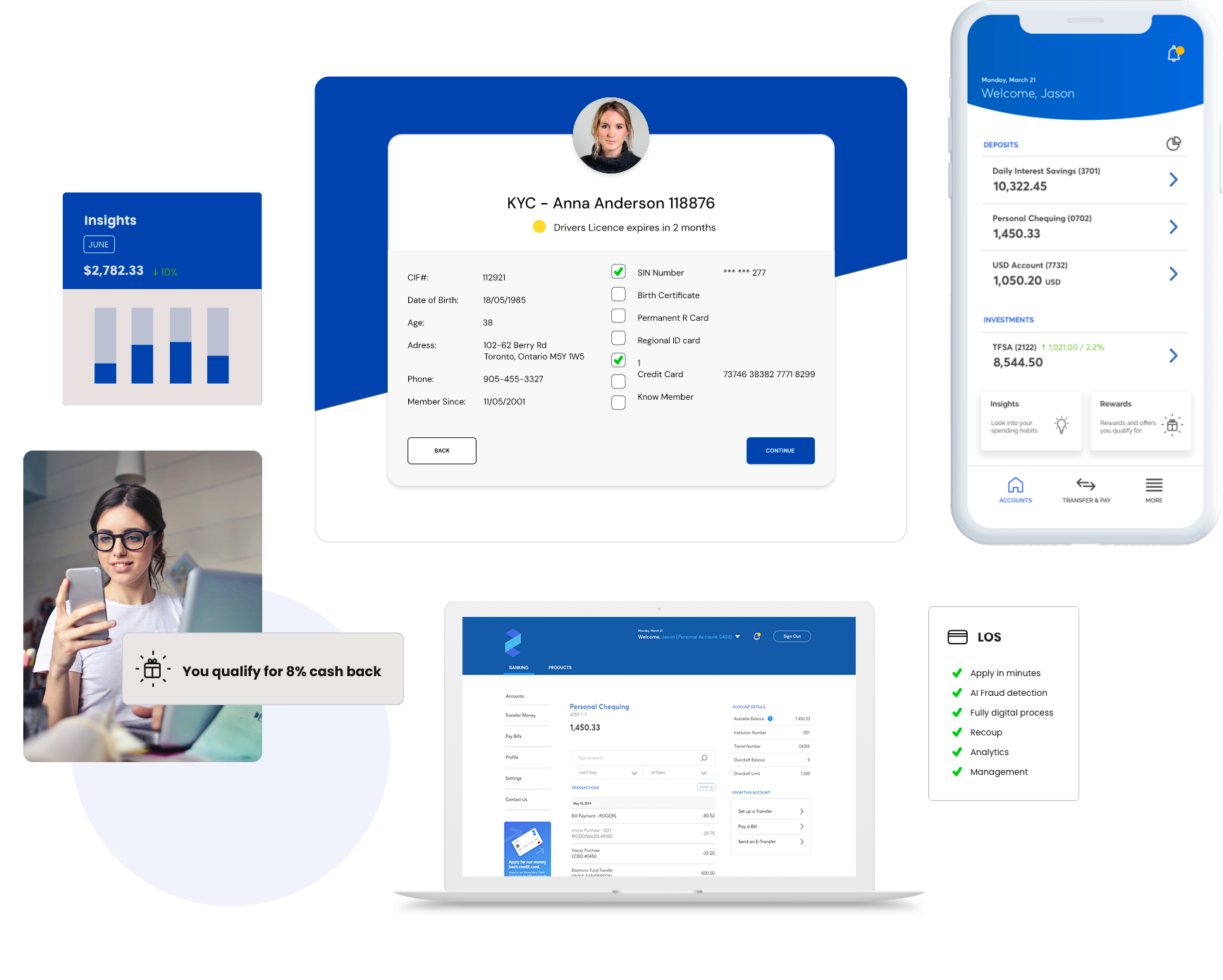

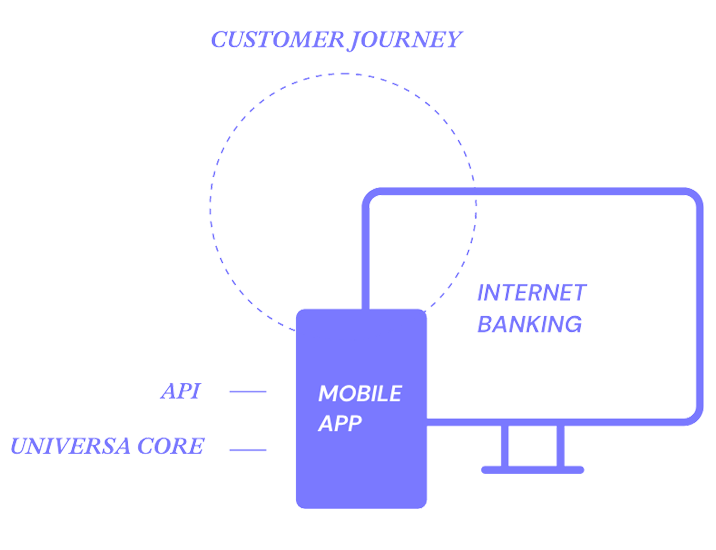

UniFi Digital Banking is Smart Solution's 3rd generation of Mobile and Desktop digital banking applications. Written using the newest frameworks and infrastructure, UniFi leverages state of the art security features while prioritizing seamless user experience for your clients.

UniFi Digital Banking ensures your clients' banking needs are met efficiently and reliably, granting them 24/7 access to their accounts, every day of the year. With UniFi Digital Banking your clients can manage their accounts, transfer funds, send bill payments, view statements, and more.

LEARN MORE

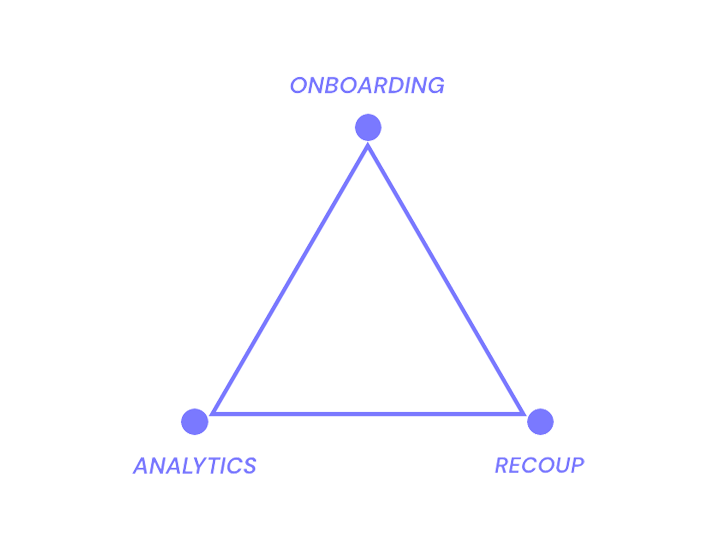

A standalone loans system that becomes more powerful when leveraged with the complete Universa suite, Smart Solution's LOS is built to manage three core functions of the loans process: simple onboarding, streamlined recoupment, and actionable insights.

With the Universa LOS system, you can take control of your onboarding, swiftly gathering applicant information, assessing eligibility, and creating loan applications within minutes. Take strategic control of fund recovery with real-time alerts. With data-driven decision-making, you can refine loan strategies, optimize workflow settings, and enhance customer satisfaction while lowering costs.

LEARN MORE

Our metrics don't just represent numbers; they signify our commitment to technological advancements, fostering growth, and enriching customer journeys.

requests per year

historical uptime

branded apps

Ensuring unmatched data safety with rigorous security protocols and advanced encryption, fortifying against any unwarranted intrusions and digital risks.

SOC 1 & 2, CSAE 3416, & AICPA Standards Compliance. Level 3 Organization. Annual security audits & always reaching for greater global compliance.

Contact us to speak with an expert and discover what solutions might be right for you and your institution.

SPEAK WITH AN EXPERT